Cross-border banking simplified

Enjoy convenient access to your accounts in online banking and the RBC Mobile app. Plus, move money easily from Canada to the U.S. and back with free and instant cross-border money transfers.1 Need money in the U.S.? With RBC Bank, you’ve got access to over 50,000 no-fee ATMs nationwide.2

How Do I...

How Do I Access and Link My Accounts?

As a digital bank, our commitment is to provide you easy instant access to your accounts through online banking, the RBC Mobile App and via phone- anytime, anywhere. Once you’re set up and you’ve linked your RBC Royal Bank (Canadian) with your RBC Bank (U.S.) accounts, you’ll be able to exchange currency and make free1 and instant transfers between your RBC accounts.

Through online banking you can access your RBC Canadian and RBC Bank U.S. accounts with a single sign-in.

Getting started with online banking

You can enroll online in about 10 minutes by visiting Online Banking Enrollment.

You’ll need to have an RBC Bank (U.S.) account number to enroll – choose from any of your U.S. accounts including checking, savings, credit card or line of credit.

Answer all the validation questions to complete your U.S. online banking enrollment.

How Do I Link My RBC Bank (U.S.) and RBC Royal Bank (Canadian) Accounts?

Link access to your RBC Canadian and U.S. accounts through online banking to allow you to complete cross-border currency conversions and transfers - instantly and for free1. Follow the simple steps through the process with the confidence that your information is secure – you’ll receive a one-time passcode to link your accounts.

Canadian online banking

- Sign in to Canadian online banking

- Select My Services > Link Other Accounts

- Select Link (unlink) your RBC Bank (U.S.) online banking

- Follow the prompts to link your accounts

U.S. online banking

- Sign in to U.S. online banking

- Select Profile and Preferences > Link My Cross-Border Accounts

- Follow the prompts to link your accounts

After you’ve linked your U.S. and Canadian accounts through Canadian online banking, the RBC Bank Mobile App allows you to easily access and move between your RBC accounts.

- Transfer money from your RBC Canadian accounts to your U.S. accounts on the go, instantly and for free1, and enjoy the ease of currency exchange and funds transfer in a single transaction.

- Stay up to date on your account transactions on both sides of the border.

- Seamlessly access online banking so you can deposit checks, pay U.S. bills, view and print your statements, and find one of the over 50,000 no-fee ATMs2 across the U.S., right from your mobile device.

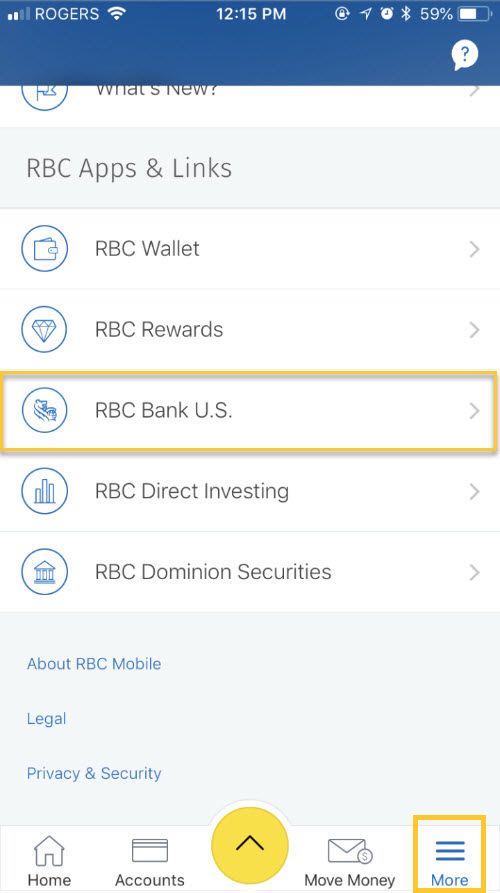

From the More menu, select RBC Apps and Links, and then RBC Bank U.S.

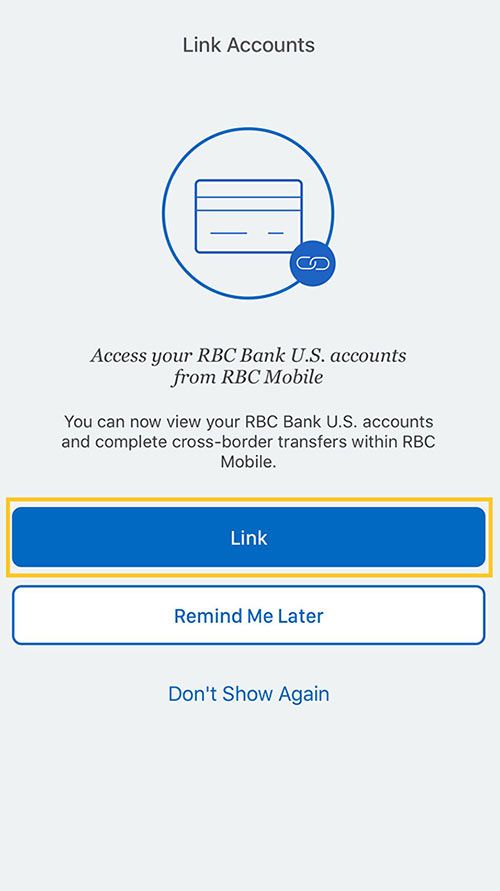

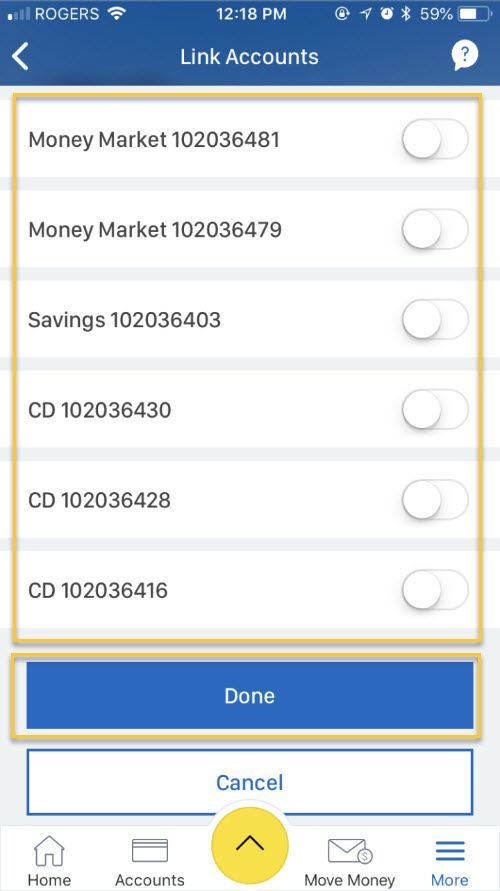

From the Link Accounts screen, tap Link

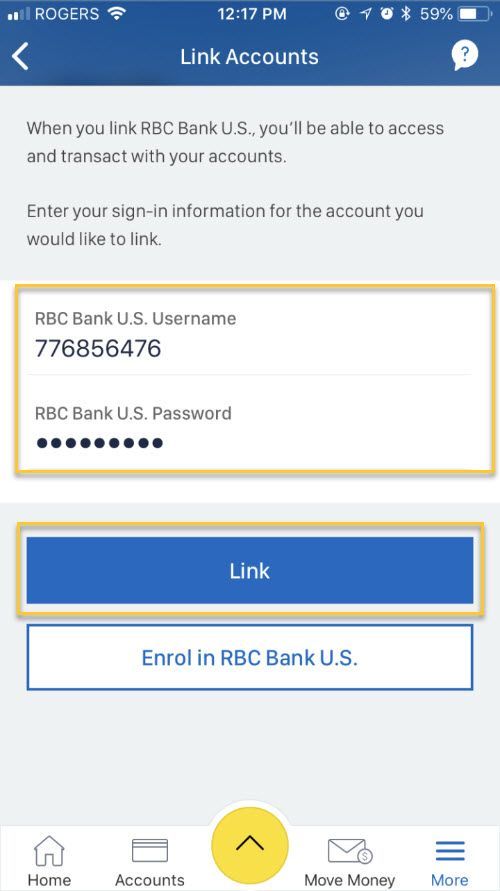

Enter your U.S. online banking username and password, and hit Link

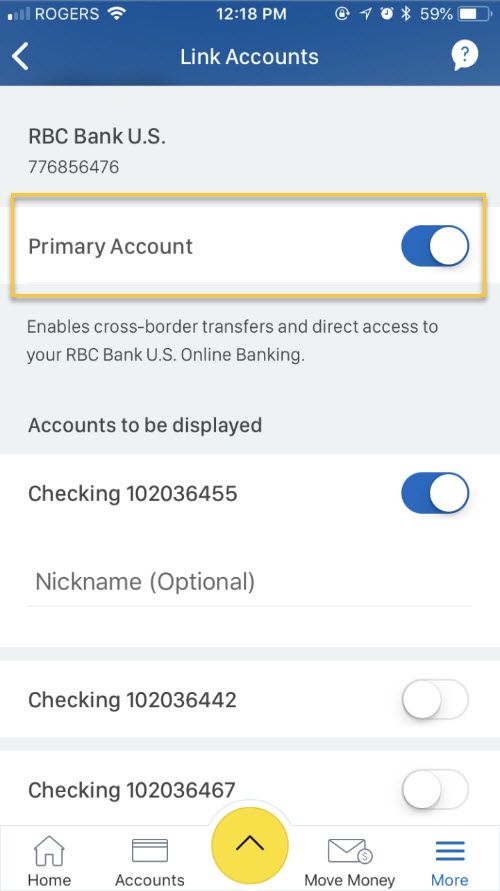

Turn on the Primary Account option

Scroll down and select which U.S. accounts you want to view in your app and hit Done

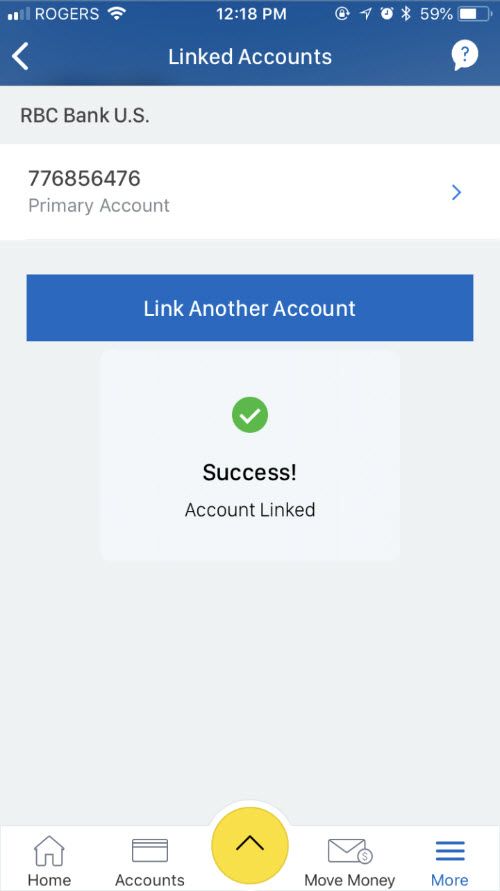

Your accounts are now linked.

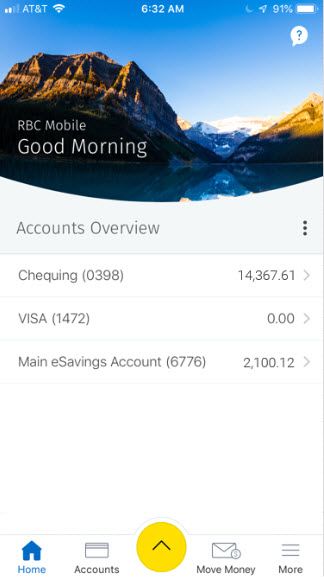

Confirm your U.S. accounts are displayed on your Home Screen. If so, you’re done

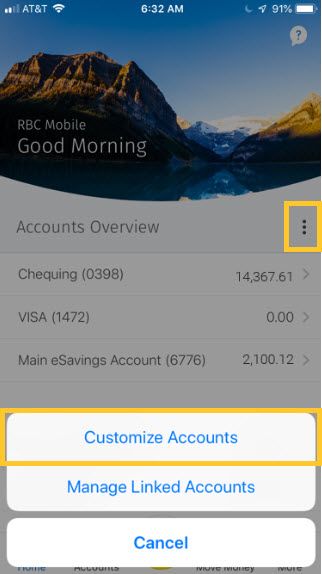

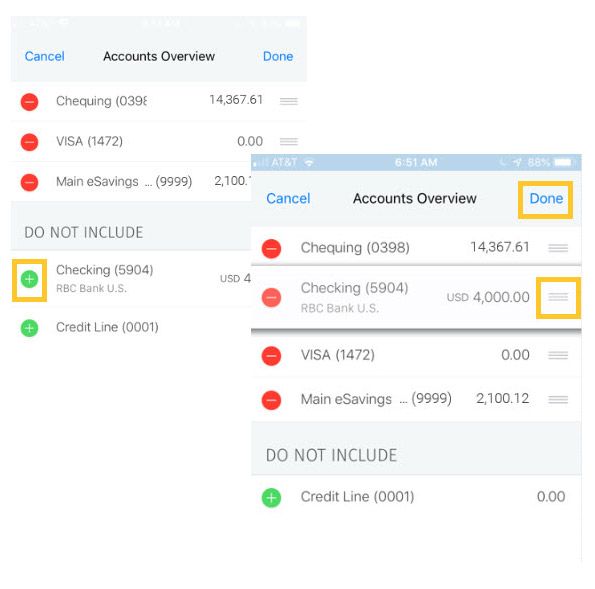

If your accounts aren’t displayed, tap the 3-dot Manage Menu button and select Customize Accounts

Choose the accounts you want displayed in the Accounts Overview and hit Done

Automated Telephone Banking is quick, and convenient. Simply use your phone to access and manage your accounts on both sides of the border.

- Transfer funds instantly1 between your U.S. accounts (cross-border money transfers can be completed in online banking)

- Get current account information – balances, interest paid, and available credit- and search for specific transactions

- Report a lost or stolen debit or credit card

- Activate your RBC Bank debit or credit card and manage your debit card PIN

- Initiate stop payments

- Order checks or get your order status

- Review your Certificate of Deposit (CD) maturity date and term

Getting Started with Automated Telephone Banking

- Sign in to RBC Bank online banking, click Customer Service, and choose My Profile & Preferences.

- Click Telephone Banking Preferences to create your secure Secret Access Code and Secret Word.

Not an online banking user? No problem! Give us a call at 1-800 ROYAL 53 (1-800-769-2553), and we’ll get you set up.

How do I move my money?

Moving money back and forth between your U.S. and Canadian accounts easily, quickly and for free1 is part of a care-free cross-border life.

Learn About Moving MoneyConvert your currency and move your money from your RBC Royal Bank accounts to your RBC Bank accounts instantly and for free1. Move up to $25,000 in a single transaction. Need to move more? Give us a call at 1-800-769-2553.

There are no limits to the number of transfers you can make.

Before you make a transfer, you first need to link your accounts. Once they are linked, you are ready to make a cross-border transfer.

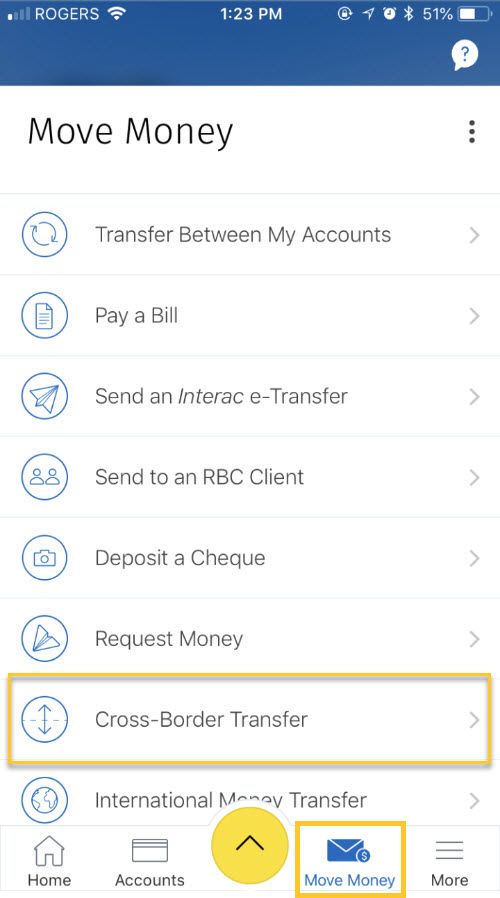

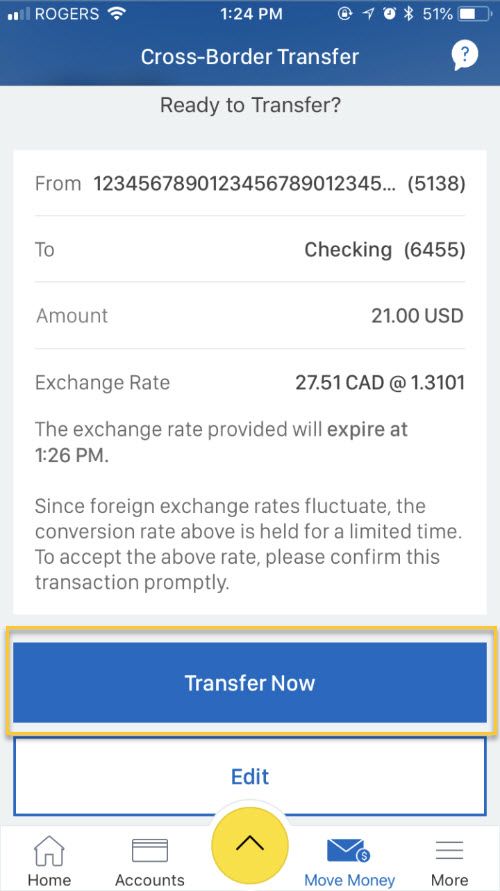

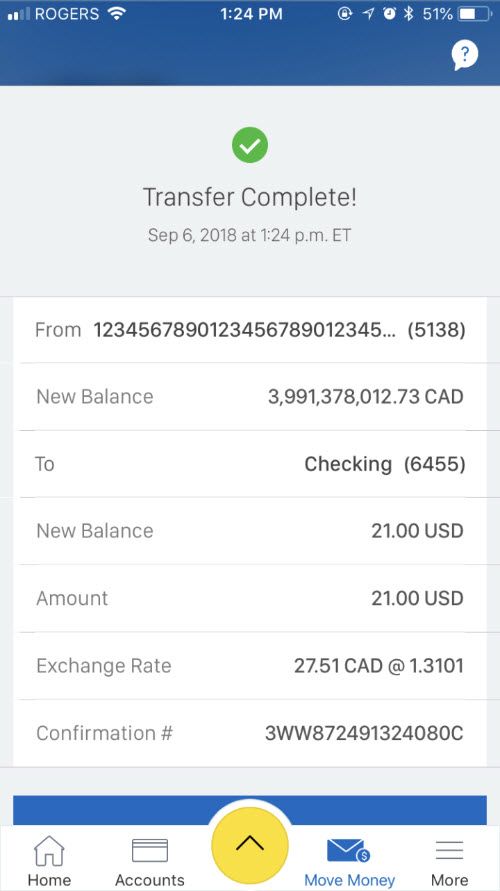

From the Move Money Menu select Cross-Border Transfer

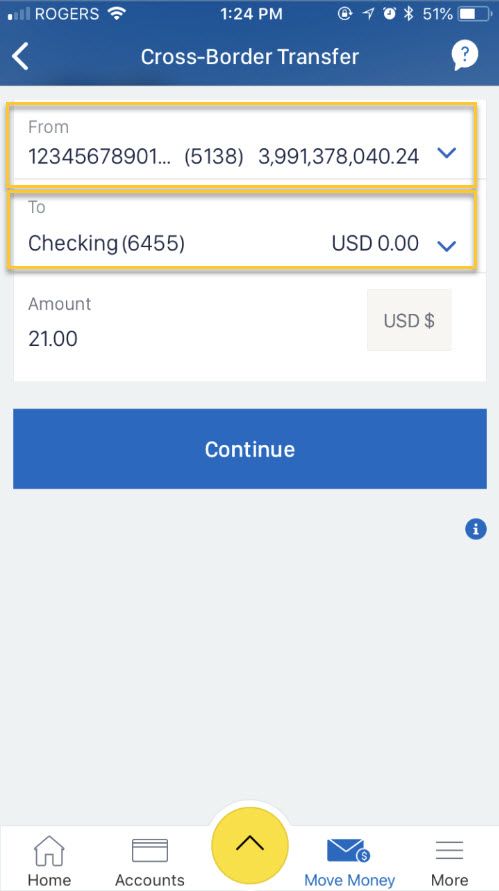

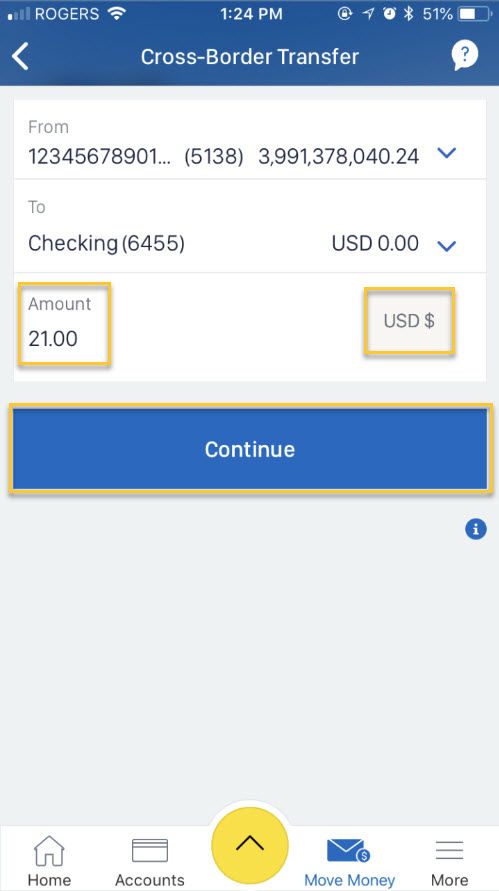

Choose which Canadian account you want to move money From, and which U.S. account you want to move money To

Now, enter the Amount, and choose your Currency. Hit Continue

Review your transfer details and confirm by hitting Transfer Now

Your cross-border transfer is complete.

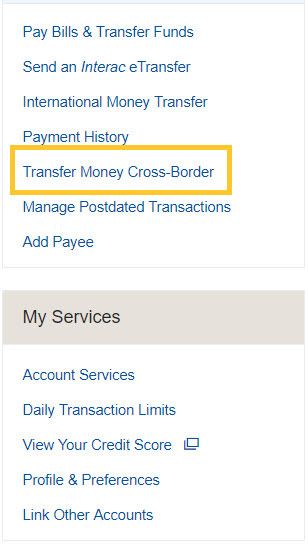

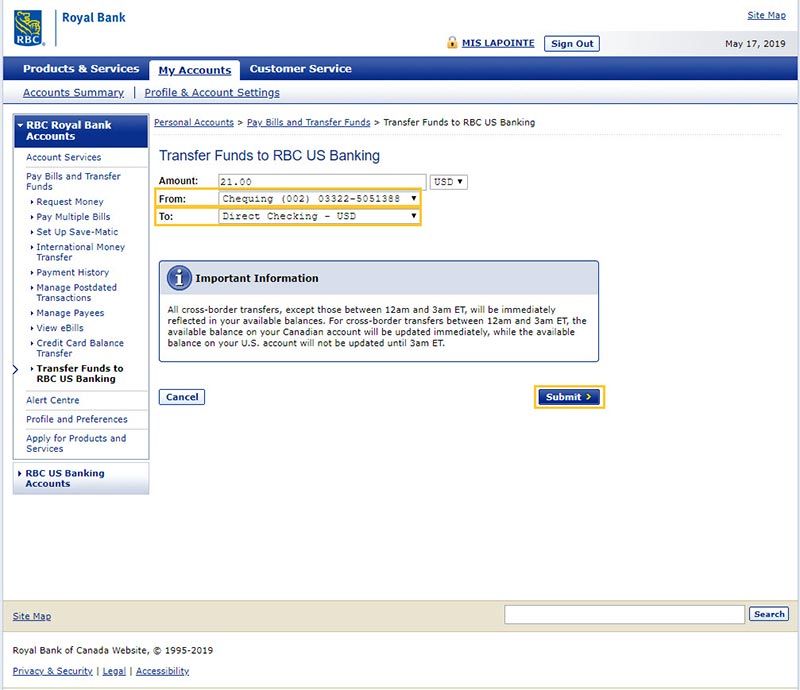

From the Account Summary page select Transfer Money Cross-Border on the right-hand sidebar

Enter the Amount of your transfer and choose your Currency

Select which account you’ll transfer From and which you’ll transfer To, then click Submit

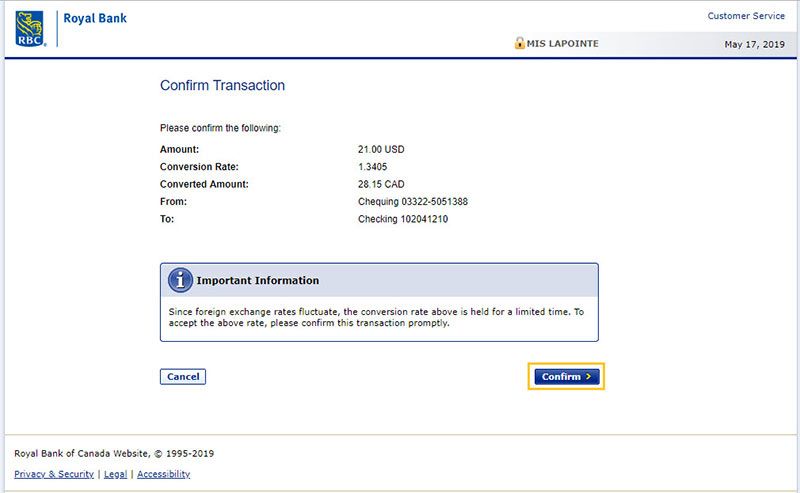

Review your transfer details and confirm by clicking Confirm

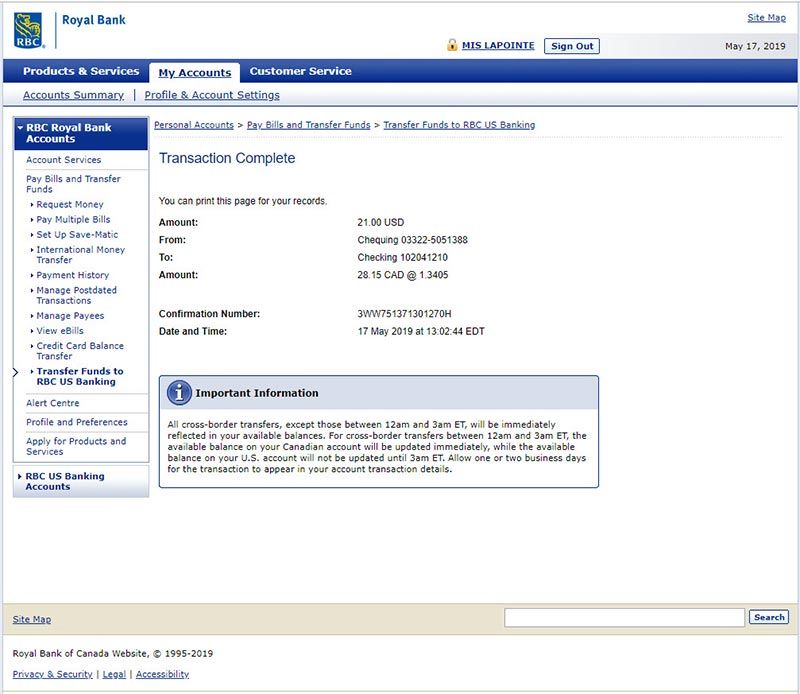

Your cross-border transfer is complete.

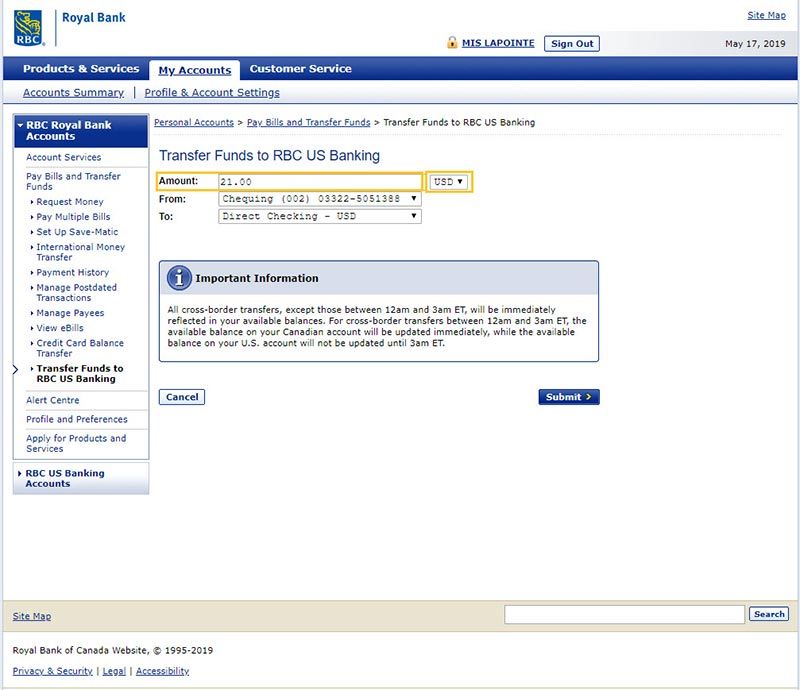

- Sign in to U.S. RBC Bank online banking.

- Click on the American Flag icon located in the upper right-hand corner of the screen and select CAN Accounts (RBC Royal Bank).

- Click on Pay Bills and Transfer Funds.

- Click on Transfer Funds to RBC US Banking.

- Type in the amount you wish to transfer.

- Select the RBC Royal Bank account you’d like to transfer from, then choose the RBC Bank account you wish to transfer to.

Convert your currency and move your money from your RBC Royal Bank accounts to your RBC Bank accounts instantly and for free1. Move up to $25,000 in a single transaction. Need to move more? Give us a call at 1-800-769-2553.

There are no limits to the number of transfers you can make with your checking account. However, U.S. banking regulations limit the number of withdrawals you can make from personal savings and money market savings accounts to six per month.

Before you make a transfer, you first need to link your accounts. Once they are linked, you are ready to make a cross-border transfer.

- Sign in to U.S. RBC Bank online banking.

- Click on the Transfer Funds tab and select USA to CAN Transfers.

- Type in the amount you wish to transfer.

- Select the U.S. account you’d like to transfer from, then choose the Royal Bank account you wish to transfer to.

You can move U.S. dollars from a U.S. bank to RBC Bank simply by writing and depositing a U.S. check to your RBC Bank account.

You can also transfer the money online to your RBC Bank personal account. Depending on the policies of the other U.S. banks you hold accounts with, these transfers may take several business days to complete.

The first step in transferring U.S. dollars between your RBC Bank personal account and other U.S. banks online is to add your other U.S. accounts to online banking.

- Sign in to online banking.

- Click the Transfer Funds tab and select Registered External Accounts from the menu.

- Click Add.

- Enter required institution and account information for the external financial institution, including routing number, account number, type of account and account owner.

- Click Submit, then log out.

Over the course of up to 5 business days, RBC Bank will make two micro-deposits (less than $1.00) to the external account you registered. Please wait for 5 business days before taking the next step. - Log in to the online banking service of your external account to verify the amounts of the microdeposits made by RBC Bank. Then, sign in to U.S. RBC Bank online banking.

- Click the Transfer Funds tab and select Pending External Accounts from the drop-down menu.

- Select the applicable external account and click Verify.

- Enter the amount of the two micro-deposits and click Submit.

Once complete, you’re ready to make transfers.

- Click the Transfer Funds tab and select USA Transfers.

- Type in the amount you wish to transfer.

- Select the accounts you wish to transfer ‘from’ and ‘to’ using the drop down menu (external accounts will appear at the bottom of each menu).

- Under the terms section, choose whether you’d like the transfer to be immediate or scheduled for a specific date(s) and frequency.

A wire transfer is an electronic transfer of money between two or more financial institutions. Depending on whether you are sending or receiving the wire transfer and whether it is domestic or international, the fees can range from $15 to $75 per transaction. Make sure to build in a cushion of time when using wire transfers, as they can take two business days to complete.

Wire Transfers in U.S. online banking (opens new window)

How Do I Get Cash in the U.S.?

There’s no need to pack a stack of cash when you head to the U.S. Running around trying to get U.S. dollars before you leave is a hassle and it’s risky to carry a lot of money with you.

There are easy ways to get cash while you’re in the U.S.

You can use your U.S. Visa debit card at one of our 50,000+ no-fee2 ATMs to access funds from your account. Use our ATM Locator to find one near you. Most will dispense up to $300 per transaction, although you can make multiple withdrawals, up to $1,500 a day.

When you make a purchase at a larger retail merchant- like a grocery store, for example - you can ask for cash back. Before you finish your debit card purchase, select “cash back” at the card terminal. The amount you can access will be limited based on the merchant, often to $100 or less, and there are no limits to the number of transactions you can make.

With a U.S. Visa Debit card, you can go to most U.S. financial institutions and show your photo ID and U.S. Visa Debit card to ask for a cash advance. You’ll be able to withdraw up to $5,000, but the amount varies based on the financial institution. The money will be immediately withdrawn from your bank account, unlike a credit card cash advance.

How do I Make a Deposit into my U.S. Account?

Your cross-border lifestyle should be as care-free as can be. Finding a way to get your U.S. dollars into the bank should be just as easy. There are lots of ways you can make your deposit.

Transferring money from your RBC Royal Bank (Canadian) account to your RBC Bank U.S. account is free1 and instantaneous. Sign in to online banking to convert and transfer your Canadian dollars into U.S. dollars in your U.S. account. And you can do it as often as you like- there are no limits to the number of transfers you can make.

To deposit U.S. funds into your RBC Bank account from accounts you have at other U.S. banks, simply register the accounts through online banking and make easy online transfers.

While RBC Bank charges no fees for this service, your other banks might. And depending on the policies at the other financial institutions, it may be several business days before you can access that money.

Using your smartphone or tablet- or your desktop computer and scanner- you can deposit U.S. dollar checks drawn on U.S. financial institutions through online banking anytime, anywhere, for free.

While this is a convenient, easy and free method to get money into your account, be sure to plan ahead- funds deposited via your device may take up to five business days to become available.

You can use your U.S. debit card to deposit U.S. cash at any of the thousands of no-fee2 ATMs across the country that accept deposits. Remember, U.S. ATMs do not accept deposits of Canadian currency- U.S. cash only.

Use our ATM Locator to find an ATM near you that accepts deposits. Please be aware that funds deposited at an ATM may take up to five business days to become available.

If you receive a U.S. dollar paycheck, or other consistent payments, you can set up automatic deposits to get that money in your account- with no fees from RBC Bank. Use the direct deposit instructions of the organization paying you or our direct deposit form. You may need our routing number to get it set up – it’s 063216608

You can initiate or receive a wire transfer- an electronic transfer of money between two or more financial institutions. Depending on whether you are sending or receiving the wire transfer and whether it is a domestic or international wire transfer, the fees can range from $15 to $75 per transaction. Make sure to build in a cushion of time when using wire transfers, as they can take two business days to complete.

Receiving a wire transfer

Wiring funds to your RBC Bank account is a two-step process. The wire must first be sent through a Receiving/Intermediary Bank, which accepts the wire on RBC Bank’s behalf. The Receiving/Intermediary Bank then sends the wire to RBC Bank.

Please be aware that the deposit credit may take up to two business days to appear on your account.

Initiating your wire transfer

- Determine the type of wire transfer you need- U.S. Wire Transfer for wire transfers originating in the U.S., or Non-U.S. (International) Wire Transfer for wire transfers originating outside the U.S.

- Select the appropriate Wire Instructions form below.

- Complete the Wire Instructions form, then print it or save it to your computer.

- Provide the completed Wire Instructions form to the person or organization originating the wire.

How Do I Pay My U.S. Bills?

Whether you’re enjoying fun in the sun in the U.S. or the comforts of home in Canada, if you have U.S. bills to pay, we help keep the process simple. Paying bills- or people- in the U.S. is a little bit different than in Canada. With no Interac eTransfer system in place south of the border, things might be a little different than you’re used to, but you still have great options to get your U.S. bills paid.

With online banking, you can pay your U.S. bills anytime, anywhere, securely and for free.

Set up bills you receive from any U.S. company or individual and pay them in U.S. funds. And since you can switch between your U.S. and Canadian accounts with a single sign in, you can take care of all of your bills, wherever you are.

Have recurring U.S. bills like a mortgage or insurance? Schedule regular payments to be sent automatically so you don’t need to give them a second thought, whether you’re in the U.S. or Canada.

How Long Does it Take for My Bills to Be Paid?

If the company you are paying accepts electronic payments from us, they will receive the payment on the day you select.

If the company does not accept electronic payments from us, we will generate a check on your behalf and mail it to the payee. There may be a several day lag time in your payment being posted as it can take a few days to arrive in the mail and the payee may require processing time of another few days. Consider setting up your payments to be sent a week or so ahead of the due date to avoid late payment fees.

Setting up Online Bill Pay

It’s quick and easy to set up and manage. Simply sign in to RBC Bank (U.S.) online banking, choose Statements and Other Services and select Bill Pay Enrollment.

When your enrollment is complete, usually on the following business day, you can access Bill Pay within online banking by clicking the Pay Bills tab.

Paying Your Bills with Online Bill Pay

Once you’ve set up your accounts in Bill Pay, you can make your payments with just a few clicks- anytime and anywhere.

- Sign in to U.S. online banking.

- Click on Pay Bills, then the Payment Center.

- Select the company or person you wish to pay.

- Enter the amount you wish to pay that biller.

- Click Make Payment.

Once confirmed, your payment will appear in the Pending Payments section of the Payment Center until it is fully processed.

Managing Your Accounts in Bill Pay

You can easily set up automatic payments, set reminders and edit payee information in Bill Pay.

- Sign in to U.S. online banking.

- Click on Pay Bills.

- Click on Manage My Bills from the menu located at the top of the Payment Center.

- Select the desired bill or biller from the drop down menu. Once selected, your account management options will be available

- Scheduling automatic payments

- Editing biller information

- Deleting a biller

- Scheduling bill reminders

- Opting to receive bills online (if biller participates)

If you prefer to use checks, you can pay your U.S. bills by writing a check drawn on your RBC Bank account and sending it by U.S. mail.

Unlike in Canada, U.S. banks will not hold post-dated checks. If you send a payee a stack of post-dated checks for ongoing expenses, the payee will be able to deposit them all at once- potentially draining your account or causing you to become overdrawn. Consider setting up recurring payments through Online Bill Pay instead.

At your request, many companies will set up your monthly payments to be drawn directly from your checking account for recurring bills like mortgage payments, credit card payments, homeowner association dues, etc. You just need to make sure the funds are in your account each month when the payment is debited. Chances are, you’ll need our routing number to get these payments set up. It’s 063216608.

Similarly, many recurring payments can be made through your U.S. credit and/or debit card. If your payee accepts these kinds of payments, simply provide your card number and expiration date to them. If you use your debit card, the funds will be drawn from your account on the day of the debit. If you use a credit card, you’ll see the charge on your monthly statement.

View Top Bank Account FAQs

Find a No-Fee U.S. ATM2 Near You

Withdraw cash at over 50,000 no-fee2 ATMs across the U.S. Find your closest location!