Make life simpler by building U.S. credit before you move

Whether you have a TN, L1, H1-B, O1, F1 or another U.S. visa, setting up your banking and credit relationship in the U.S. before your move can make your life simpler.

U.S. Bank Account

U.S. Bank AccountDirect Checking

Whether you are paid in Canada or the U.S., an account to provide you unlimited instant online exchange and transfers.

Annual fee: $0 for the first year

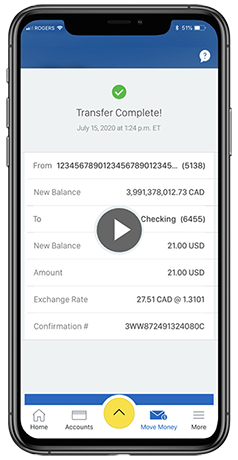

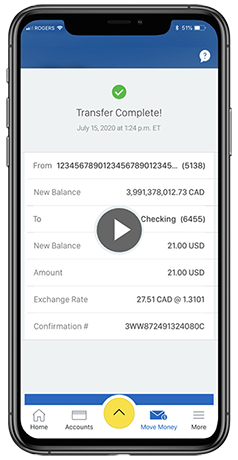

No more drafts and wires. Enjoy free transfers between your RBC Royal Bank (Canada) and your RBC Bank (U.S.) accounts — 24/7 with no delay from your computer or mobile device.

Watch How Easy It IsVisit our no-fee ATM locator to find one near you. It’s convenient to get cash at popular nationwide retailers like Target,‡Legal Disclaimer Walgreens and CVS.

U.S. Credit Card

U.S. Credit CardVisaLegal Disclaimer (opens in popup)‡ Signature Black

A no annual fee U.S.-based rewards credit card that uses your Canadian credit history to qualify.

Intro APR: 0% for 6 months

Save 2-3% on U.S. purchases by avoiding foreign transaction fees – and make returns in USD, without concern for currency fluctuations.

Redeemable for travel, gift cards, merchandise, unlimited 1% cash back.

- No blackout periods or seat restrictions.

- Redeem points for flights and hotels.

- Easily manage and redeem your points for travel through online banking.

Thinking of buying a U.S. home?

We're with you. With the relative affordability of U.S. homes and low interest rates, now may be a great time to invest in a U.S. home. RBC U.S. HomePlusTM Advantage is built exclusively for Canadians to provide full-service support through every step of the U.S. homebuying process.

The only U.S.-based bank designed specifically for cross-border Canadians

Making the move to the U.S. from Canada and wanting to make a smooth transition? Whether you’re moving for a new career, school or to retire, we’re with you. We make cross-border banking easy and secure.

- Easy access to cash with over 50,000 no-fee ATMs in all 50 states

- Use your Canadian credit history, address and ID to apply

- Manage your money anywhere, anytime through mobile, online and telephone banking

How we make cross-border banking easy

The Only U.S.-Based Bank Designed Specifically for Cross-Border Canadians

Making the move to the U.S. from Canada and wanting to make a smooth transition? Whether you’re moving for a new career, school or to retire, we’re with you. We make cross-border banking easy and secure.

- Easy access to cash with over 50,000 no-fee ATMs2 in all 50 states

- Use your Canadian credit history, address and ID to apply

- Manage your money anywhere, anytime through mobile, online and telephone banking

How we make cross-border banking easy

Apply online in just 5 minutes

It's easy and quick. You can start your no obligation application online right now. It usually takes less than 5 minutes and you can even open your U.S. bank account immediately.

Apply by October 31, 2026 and enjoy no annual fee cross-border banking for 1 year.